2026 Budget Priorities Survey

Every year, the Township develops a budget that helps shape the services, programs, and projects in our community. From maintaining roads and essential infrastructure to parks and supporting recreation as well as emergency services, the budget outlines how your tax dollars are invested to keep Cramahe a great place to call home. Understanding how the municipal budget works is the first step in helping guide local priorities and planning for our community’s future, together. Please take some time to review the following and participate in the survey below with your feedback.

Understanding Your Municipal Property Tax Bill

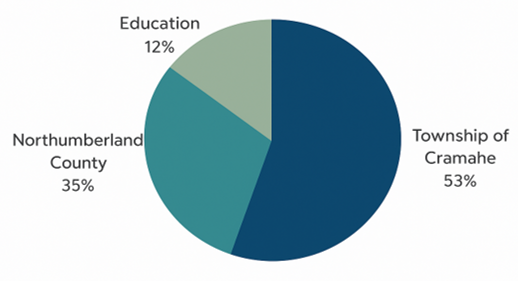

Municipal property tax bills are made up of three parts:

- the amount paid to Township of Cramahe;

- the amount paid to County of Northumberland; and,

- the amount paid for education as set by the Government of Ontario.

Not all municipal services are completely funded through taxes. Services like water and wastewater are fully funded through user fees paid by people who use or benefit from these services. Some municipal services are also fully funded or funded in part through payments from the provincial or federal government.

Value For Tax Dollars in 2025

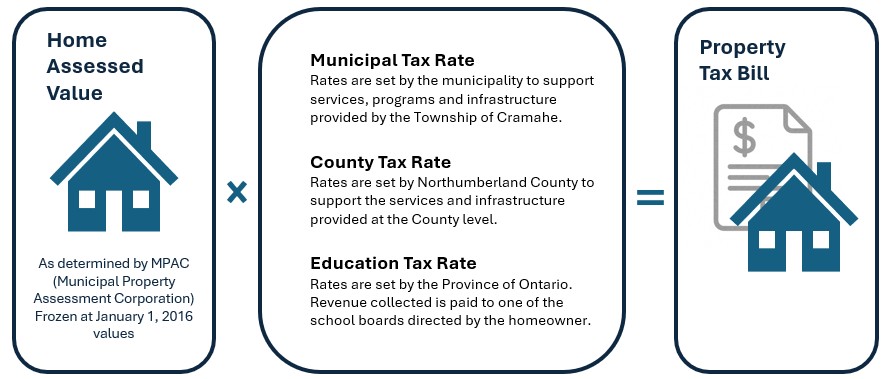

How property taxes are calculated

Municipalities set their annual tax rates by considering:

- funding requirements approved in the budget. Each year, the Township of Cramahe prepares a balanced budget to support essential services (roads maintenance, fire protection, recreation, and clean water). Under Provincial legislation, the Township cannot run a deficit or have a surplus. The budget must balance to revenues equaling expenditures.

- value of the tax base (how costs are shared across taxpayers). MPAC (Municipal Property Assessment Corporation determines property assessments for all properties in Ontario. It's important to note that this assessed value is different from the market value of a home

In 2025, the Township of Cramahe share of municipal taxes for an MPAC-assessed average residential property of $262,000 is $2,325.49. This does not include part of your municipal tax bill that is paid to Northumberland County and to your preferred Ontario school board.